The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the short-term or long-term. Revenue expenditures are typically referred to as ongoing operating expenses. Capital expenditures are typically one-time large purchases of fixed assets that will be used for revenue generation over a longer period.

Capital Expenditures

Capital expenditures represent major investments of capital that a company makes to maintain or, more often, to expand its business and generate additional profits. Capital expenses are for the acquisition of long-term assets, such as facilities or manufacturing equipment. Because such assets provide income-generating value for a company for a period of years, companies are not allowed to deduct the full cost of the asset in the year the expense is incurred; they must recover the cost through year-by-year depreciation over the useful life of the asset. Companies often use debt financing or equity financing to cover the substantial costs involved in acquiring major assets for expanding their business.

Example of Capital Expenditures: Exxon Mobil Corporation(XOM)

Capital expenditures such as fixed assets are located on the balance sheet. However, the cash out for purchasing the asset is shown on the statement of cash flows as seen below on Exxon Mobil’s 2017 10K statement (highlighted in red). Exxon’s total capital expenditures exceed $15 billion for 2017.

Revenue Expenditures

Revenue expenses are shorter-term expenses that are broken down into two categories:

Expenditures for generating revenue include expenses required to meet the ongoing operational costs of running a business, and thus are essentially the same as operating expenses. Unlike capital expenditures, revenue expenses can be fully tax-deducted in the same year the expenses occur.

Expenditures for maintenance of revenue-generating assets include the ordinary repair and maintenance costs that are necessary to keep the asset in working order without substantially improving or extending the useful life of the asset. Revenue expenses related to existing assets include repairs and regular maintenance as well as repainting and renewal expenses. Revenue expenditures can be considered to be recurring expenses in contrast to the one-off nature of most capital expenditures.

Example of Revenue Expenditures

Exxon Mobil Corporation (XOM)

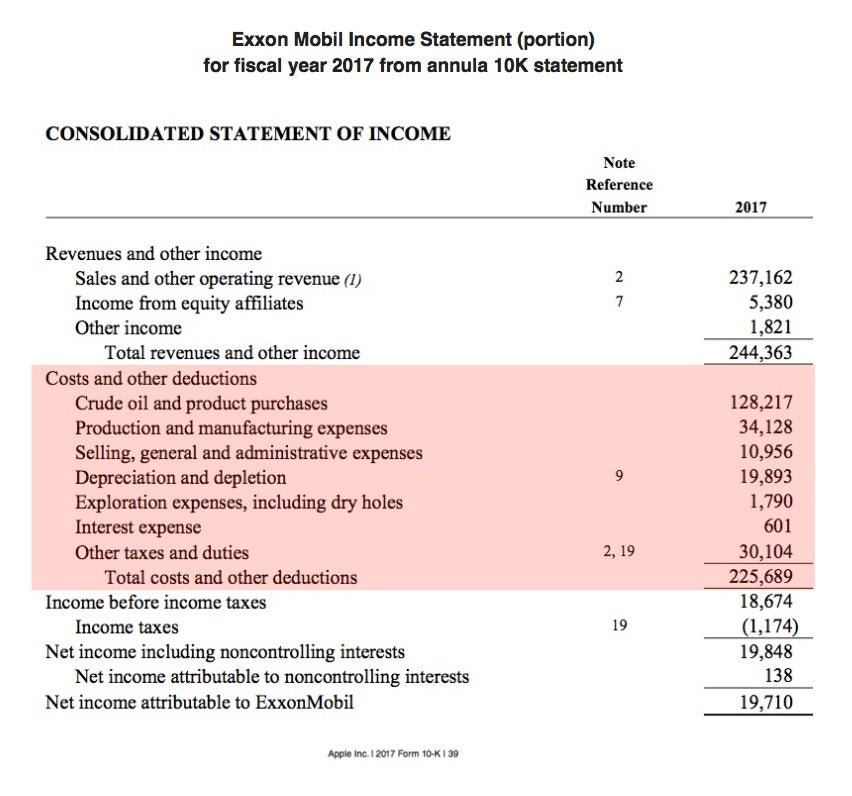

Revenue expenditures are located on the income statement as shown below on Exxon Mobil’s 2017 10K statement (highlighted in red). Exxon’s total revenue expenditures exceed $225 billion for 2017.

Bottom Line

Capital expenditures are fixed assets like property plant and equipment. Revenue expenditures are short-term expenses used in the current period or typically within one year.

Capital expenditures are typically a larger amount than revenue expenditures. However, there are exceptions when large asset purchases are consumed in the short term or in the current period.

Capital expenditures are typically expensed over many perio…